September 2024: Market Update

/On October 4, the Toronto and Region Real Estate Board (TRREB) released its highly anticipated September sales report, shedding light on the current state of the real estate market. With the ongoing adjustments following high interest rate increases aimed at combating post-COVID inflation, this period is crucial for both buyers and sellers.

September 2024 vs. September 2023

The latest report reveals a generally stable market. Here are the key highlights:

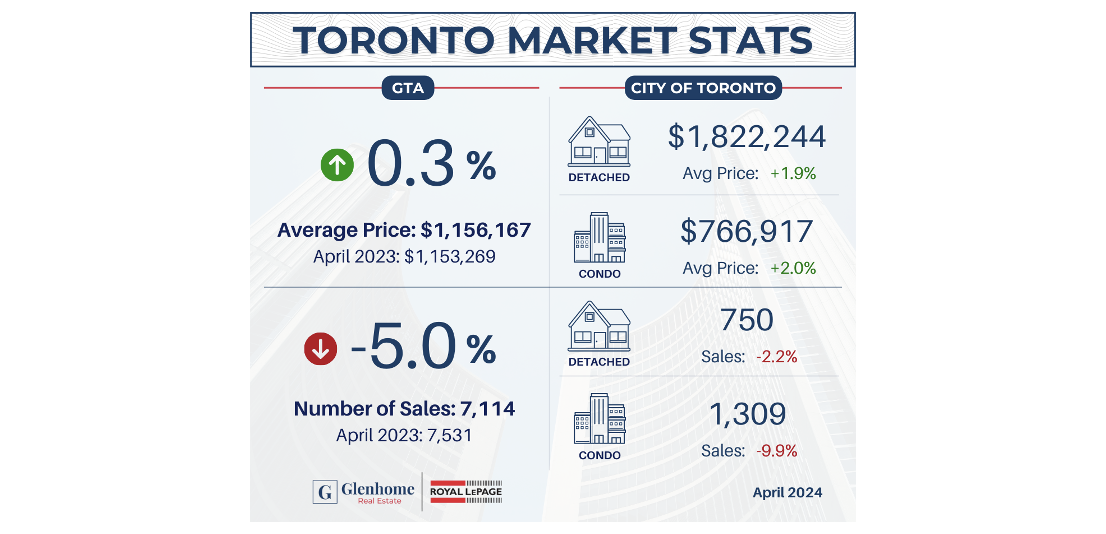

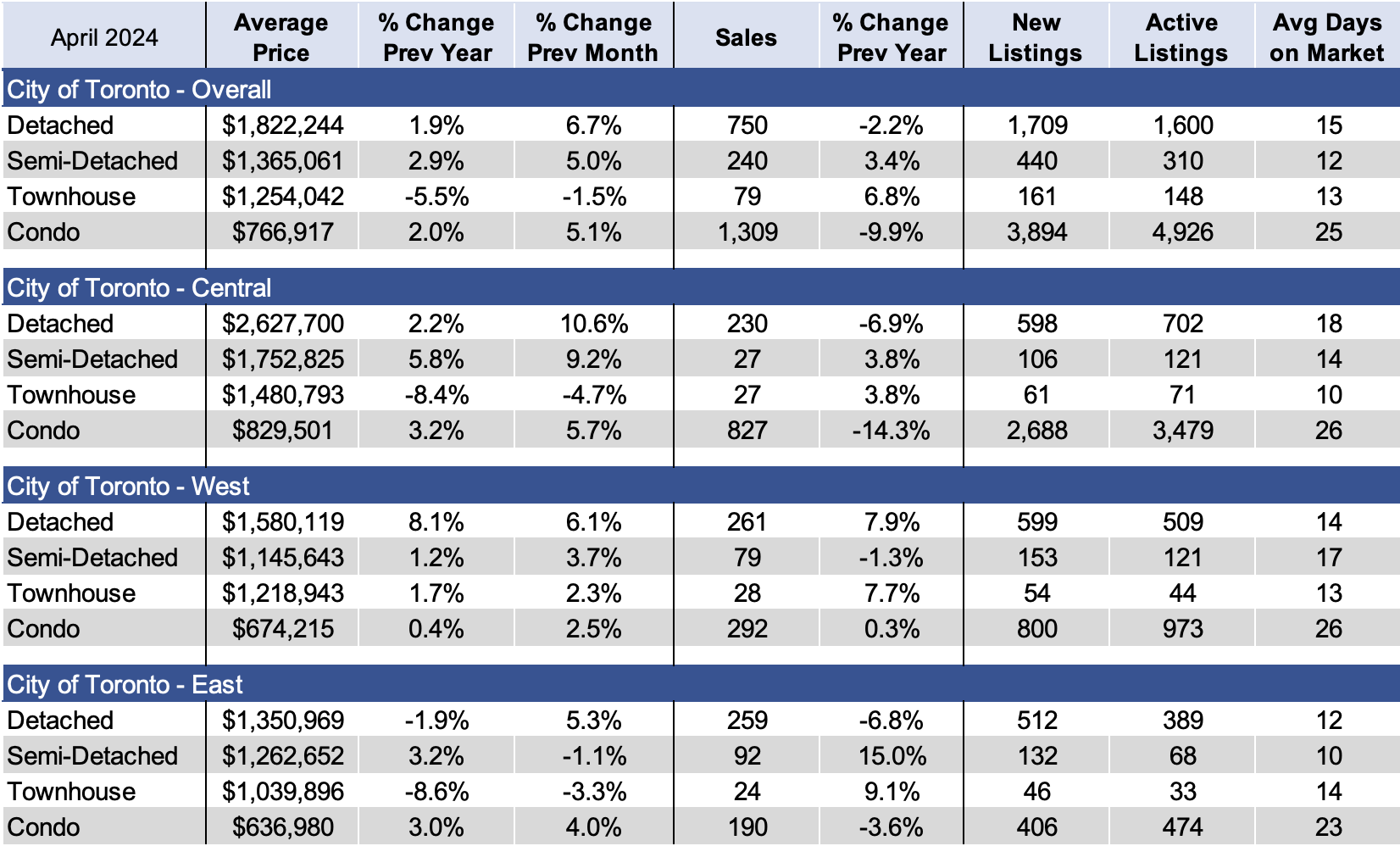

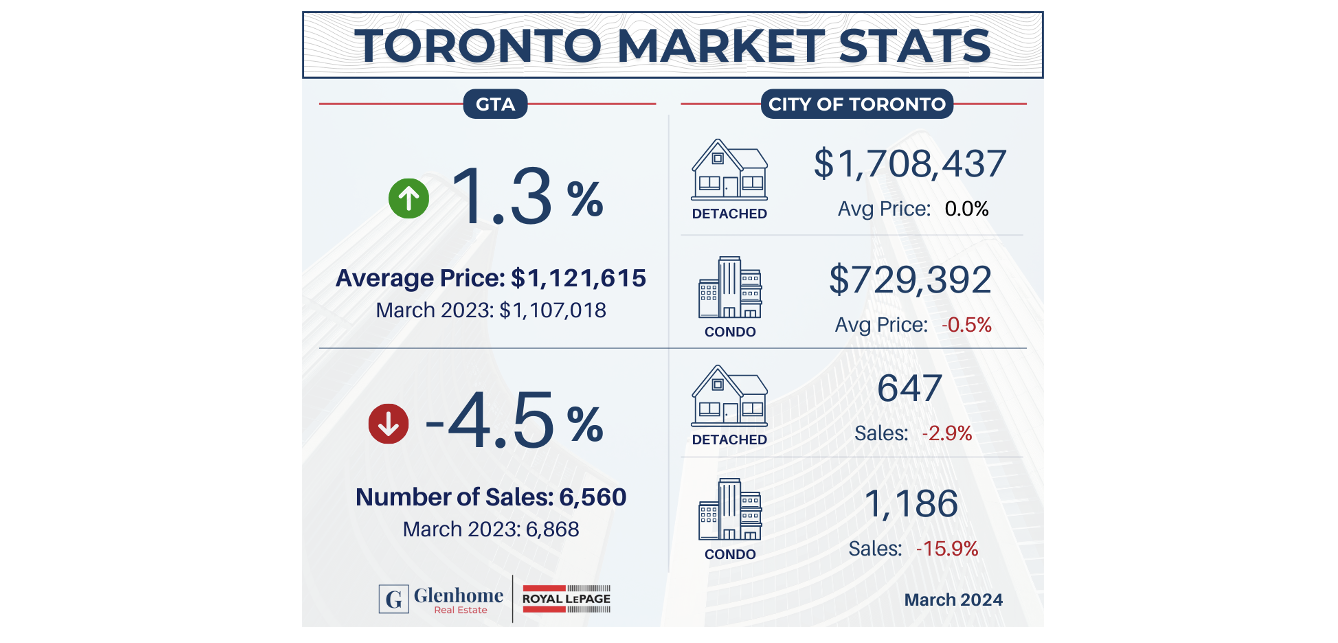

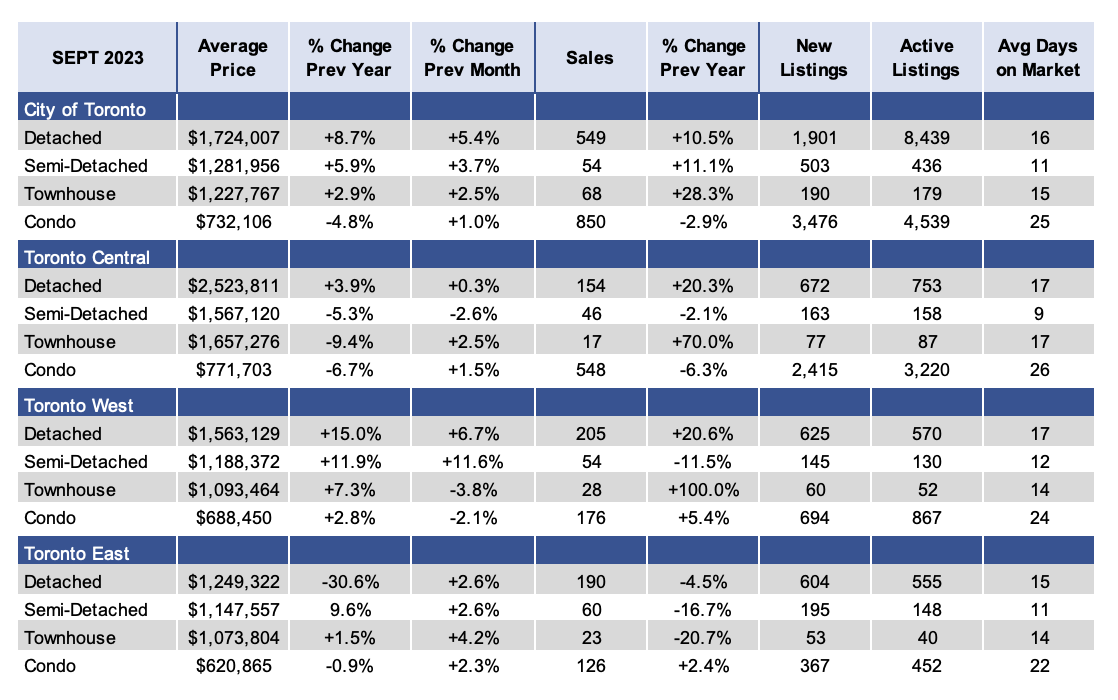

Sales Volume: There was an impressive 8.5% increase in sales compared to September 2023, marking the largest uptick in a long time.

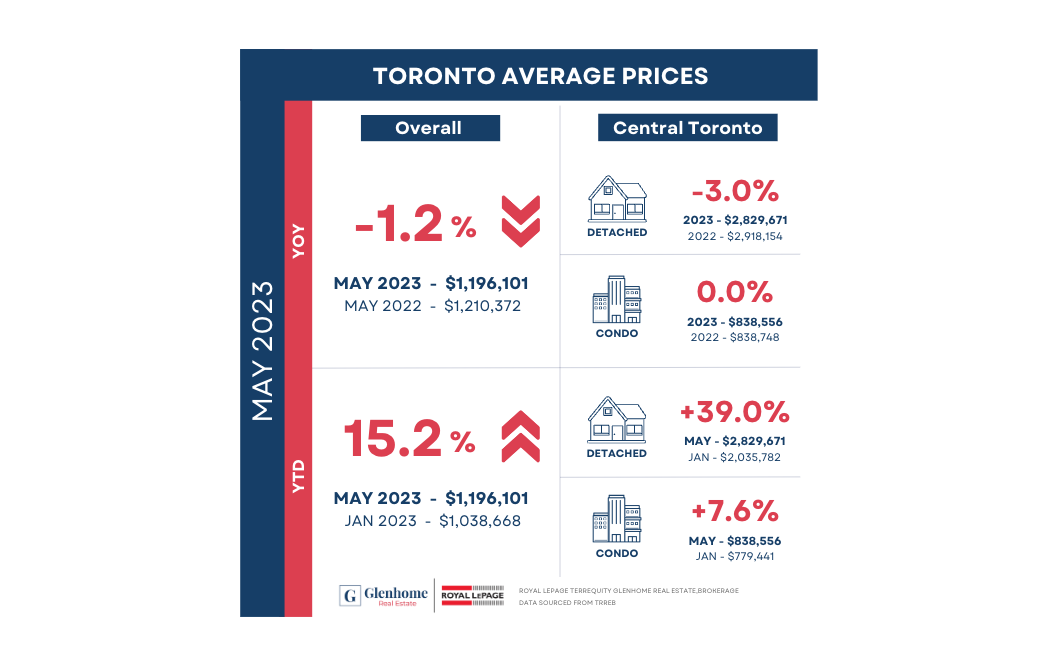

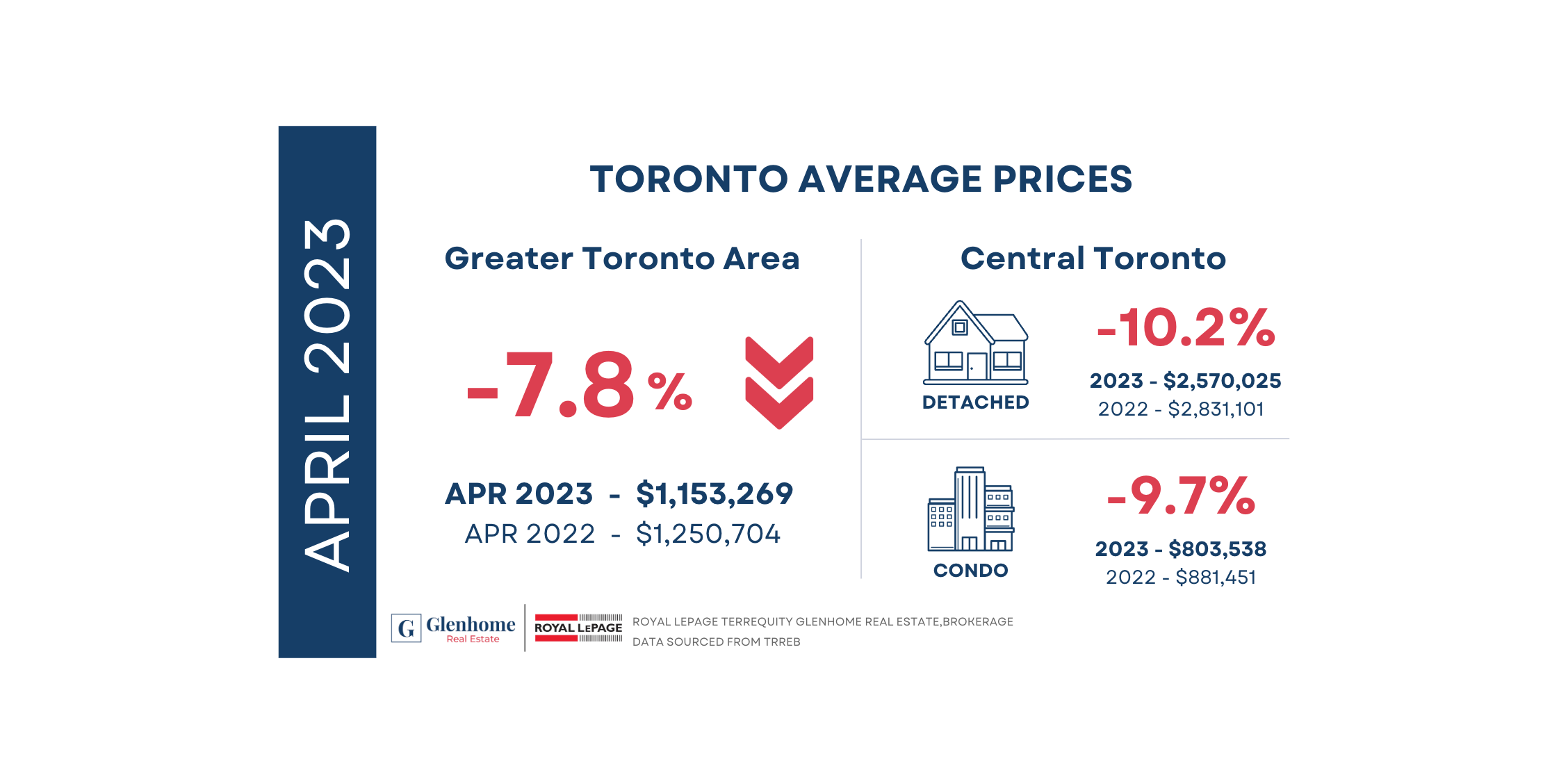

Home Prices: Prices have remained largely flat, with a slight decline of 1% year-over-year.

Days on Market: Homes are taking longer to sell, with an increase of 43.3% in the average days on the market. This trend is largely driven by condos, which are showing more prolonged sales periods compared to freehold homes.

What Does This Mean for the Market?

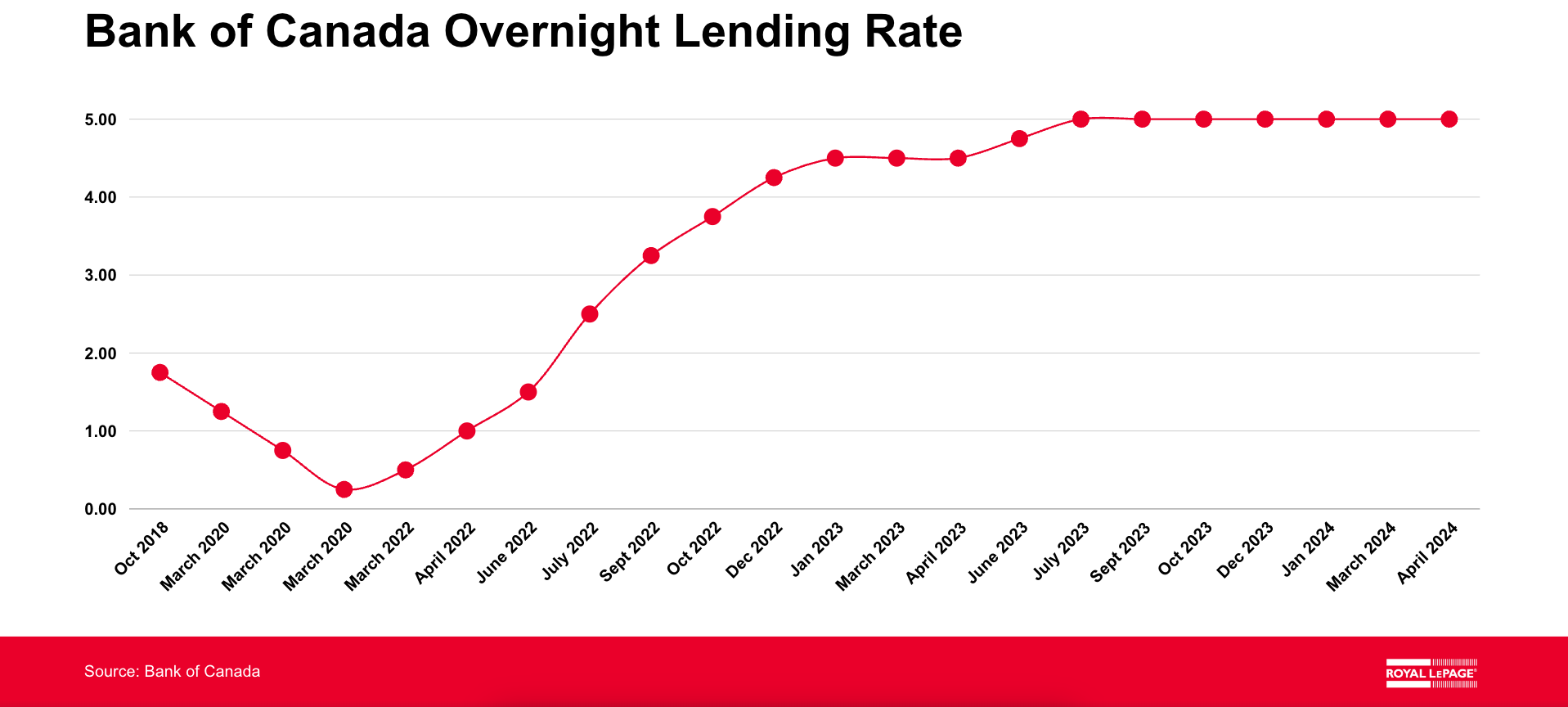

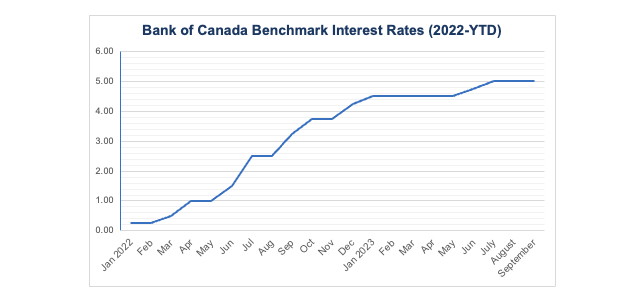

Looking ahead, expectations are building for a potential decrease in the prime lending rate from the Bank of Canada on October 23. If this occurs, it could bring mortgage rates down to the 4.5-4.7% range. Furthermore, if inflation remains stable, another rate cut could be possible in December. These changes could lead to a more dynamic Spring Market, providing a promising outlook for sellers.

Opportunities for Buyers

For potential buyers, now may be the ideal time to enter the market. Here’s why:

Short-term Mortgage Advantage: Buyers can secure a short-term mortgage now and renegotiate later if rates decrease further.

Cost Savings: Even if interest rates go down, but you purchase a home at today’s rates, can save buyers significant amounts compared to waiting for prices to rise as market activity increases.

Increased Inventory: With more properties available, buyers have greater choices, making it a strategic moment to find the right home.

Conclusion

As the market adjusts to changing economic conditions, both buyers and sellers have opportunities to navigate this evolving landscape effectively. The combination of potential rate cuts and increased inventory suggests that September 2024 could serve as a pivotal moment for those looking to engage in the Toronto real estate market.